In an ever-changing world, the well-being and safety of all sections of society hold utmost importance. This pertains particularly to elderly individuals who, having devoted their lives to laying the groundwork of our nation, deserve special consideration. Understanding the necessity of ensuring economic security and respect for retirees, the Indian government launched the Pradhan Mantri Vaya Vandana Yojana (PMVVY). This pioneering pension scheme is meticulously crafted to grant senior citizens the authority of a dependable income stream, thereby nurturing their financial autonomy throughout their cherished golden era.

The Genesis of PMVVY

Launched in May 2017, the Pradhan Mantri Vaya Vandana Yojana is a government-backed pension scheme administered by the Life Insurance Corporation of India (LIC). Its primary objective is to address the financial concerns faced by senior citizens in India. With increasing life expectancy and changing economic dynamics, the need for a robust retirement income plan became evident. PMVVY emerged as a solution to ensure that senior citizens can lead a dignified life even after retirement.

Key Features

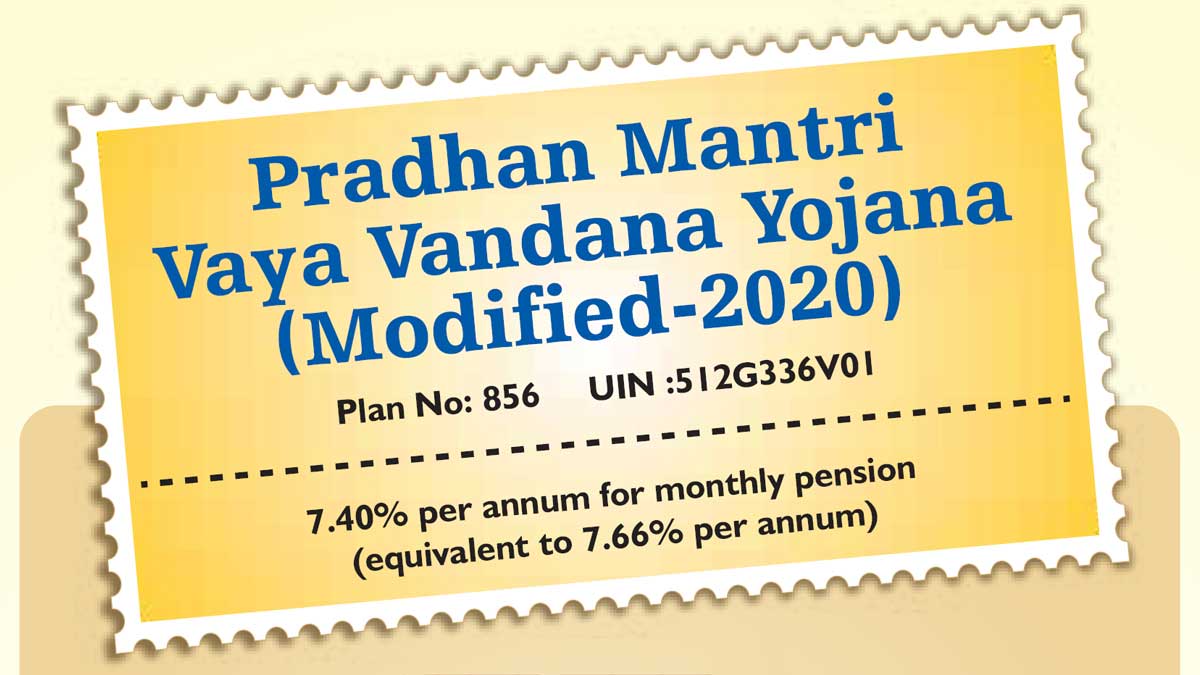

Guaranteed Returns: One of the most attractive features of PMVVY is the guaranteed regular pension payments. Beneficiaries receive a fixed pension amount, which provides a stable income source regardless of market fluctuations.

High-Yield Interest: PMVVY offers a significantly higher interest rate compared to other traditional investment avenues for senior citizens. This competitive rate serves as a buffer against inflation and ensures that retirees can maintain their purchasing power over time.

Flexible Payout Options: This scheme provides flexibility in selecting the frequency of pension payouts. Beneficiaries can choose to receive monthly, quarterly, half-yearly, or annual pension payments, depending on their financial requirements.

Limited Investment Period: The scheme’s investment tenure is ten years, which offers a sense of stability and predictability for the beneficiaries.

Minimum and Maximum Investment: The minimum investment amount for PMVVY is reasonable, making it accessible to a wide range of retirees. Moreover, there is no upper limit on investment, allowing individuals to invest according to their financial capabilities.

Loan Facility: In cases of urgent financial needs, PMVVY provides a loan facility after three policy years, which serves as a safety net for unforeseen circumstances.

Nomination Facility: The scheme allows policyholders to nominate a family member to receive the corpus in the event of the policyholder’s demise, ensuring the financial well-being of dependents.

Benefits for Senior Citizens

The Pradhan Mantri Vaya Vandana Yojana extends numerous benefits to senior citizens, helping them navigate the challenges associated with retirement:

Financial Security: PMVVY offers a consistent pension, which acts as a reliable source of income post-retirement, alleviating financial uncertainties.

Tax Benefits: The pension income generated from PMVVY is eligible for income tax exemptions under Section 10(14) of the Income Tax Act.

Reduced Dependence: The scheme empowers senior citizens to maintain their independence by providing them with a regular income stream, reducing their reliance on family members or other support systems.

Protection against Inflation: The higher interest rate offered by PMVVY safeguards retirees against the eroding effects of inflation, ensuring that their pension maintains its real value.

Conclusion

The Pradhan Mantri Vaya Vandana Yojana exemplifies the unchanging dedication of the Indian government to ensuring the well-being of its elderly citizens. By offering a reliable and secure source of income that remains unaffected by inflation, this scheme empowers retired individuals to approach their post-retirement years with financial assurance and a dignified outlook. The PMVVY not only highlights the government’s forward-looking strategy but also demonstrates its firm resolve to establish an all-inclusive society where the welfare of each person is of utmost significance. As the program consistently extends its benefits to senior citizens across the nation, it exudes positivity, heralding a future that is more promising and safeguarded for our respected elders.

Read More:- GATE 2024 Registration Now Open – Step-by-Step Application Guide and Examination Fees